Serving in the military means your financial life is never just about paychecks. It’s tied to timing, benefits, deployments, and […]

During my television years, I’ve covered the really bad mistakes individual investors make when they attempt to reposition their investments in anticipation of a changing administration. This year it’s even more emotional, and for that reason, I want to try to save you some grief!

Each election season we see and hear the same crazy accusations about each candidate and how their potential presidency will disrupt your life, particularly your investments. Whoever wins, the other side will declare that the economy and markets will dive to “never before seen” lows.

It doesn’t matter how loud these voices get, or how much the left and right collide, the stock market doesn’t care.

Let me show you why. Historically, the markets don’t waver up or down based on who wins the presidential election. In fact, most of the volatility can be attributed to investors like you and me, who are reacting to sound bites about inflation, unemployment, personal tax rates, and the overall economy. You’ll also hear pundits on 24-hour cable networks telling you which stocks you should buy if so-in-so is in the white house. Don’t buy what they’re selling because they have to make TV 24-7. I know, I used to do it!

The reality is the U.S. stock market is well-positioned for another year of impressive growth, building on the momentum of the previous year. Many of us have benefited from the substantial gains from tech stocks and with the unemployment rate continuing to drop from record highs during covid, the outlook from institutional investors remains positive for the foreseeable future.

Whether it’s Trump or Kamala, these trends are unlikely to be affected solely based on the winner. Wall Street will continue to monitor and evaluate the markets based on economic data and company profits rather than who’s in charge or what policies they preach to impose. So what does that mean for you? My advice is to proceed, business as usual.

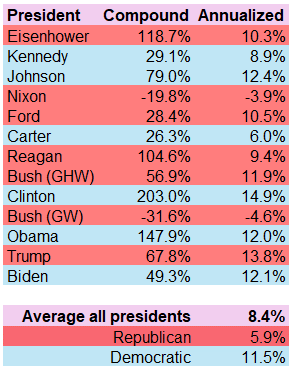

But don’t just take my word for it, look at the data! Below are the compound and annualized returns of the S&P 500 under different administrations from 1953 to the present:

Based on that data, you’d probably think that the markets will negatively react to a Republican (Trump) elected. However, these numbers don’t always tell the full story. There are many underlying political and economic factors at play here that have a more direct impact on the markets, like for example the Great Depression or war.

I also went out and spoke with a few of the advisors in my network. I asked them what some of their clients have been asking and got their advice on how to best proceed with their investments heading into this year’s election. You’ll find that many of their clients are wondering the same things you are, but the advice remains the same… don’t react!

Donald Nicholson, CFP® in Wilmington, Delaware is reassuring his clients that their focus should be on fortifying their financial core. Americans spent the better part of a year preparing for a second matchup between President Joe Biden and former President Donald Trump. But now that’s just changed.

“When the world is shaky and unstable, what’s needed is greater stability and a strong core.”

When we think about change, whether at work or in our financial lives, we often focus solely on getting through each day. But creating stability for the long-term is just as important as managing daily ups and downs.

Financial advisor David Edwards in New York City shares the same sentiment that I do. Many of his clients have reached out this summer to ask him, “Do I need to radically change my portfolio, or even sell everything, based on who the next president will be?”

His short answer is no.

“Generally speaking, the stock market does not care which party controls the White House. Indeed, investors generally prefer when power is split between the two parties. Not much can get done, and the status quo is fine as far as most companies are concerned.”

Advisor Rachael DeCosta from Sax Wealth Advisors discusses this topic frequently with her clients, especially since she lives/works in the Washington D.C. area.

“Many assume I have insider knowledge of politics. But in reality, I, like everyone else, have to sift through the noise to find relevant information. As we approach November, every client conversation involves the question “What should I be doing with my investments in light of the contentious Presidential election? I am concerned about …” My light-hearted response is, “Let me check my crystal ball and get back to you.”

While it’s essential to validate these concerns, it is equally crucial to provide an informed response. I share with clients research demonstrating that since 1926 there is no significant correlation between equity market performance and the administration in office. At Sax Wealth Advisors, we recognize each administration has its priorities, but we are not altering our investment strategies based on the upcoming presidential election and potential outcomes.”

Matthew McKee, CFP®, CFA® in New York City offers caution to taking a candidate at their word. Because remember that the president-elect’s promises aren’t the end all be all, any changes would still have to be passed through Congress and the Senate.

“As is usually the case in election years, investors on both sides of the political aisle are concerned about the impact of policy changes on financial markets. Some of the things we’re paying attention to are proposed changes to personal and corporate tax rates and tariff and trade policies, particularly given the backdrop of federal budget deficits, debt, and the risk of re-stoking inflationary pressures. However, campaign rhetoric and promises may differ substantially from what transpires, especially if the government remains divided. So, while we are keeping a close eye on the potential for short-term changes, investor’s long-term strategy likely should remain the same - keep calm and carry on.”

Jeff George, CFA® in Orlando, Florida acknowledges that while the markets may be volatile during this presidential election season, the most important thing he advocates is remaining comfortable with your existing plan and the risk behind it.

“Market volatility almost always picks up around election cycles. Regardless of your political affiliation, the most important thing is to make sure you're fully comfortable with the level of investment risk you're taking. If you're not sure you are, now would be a good time to reassess your risk tolerance.”

These are all established fee-only advisors in my network. If you’re concerned or have questions about what to do then I would strongly encourage you to start up a conversation with one of our advisors. The advice is coming from fiduciaries and is impartial so you can be assured that whatever you decide to do will make the most sense for you and your family.

So onward into this election season! And my advice is the same today as it was back in 1992. Do not put your hard-earned savings at risk by reacting to changes you cannot control.

If you’re thinking about working with a financial advisor,

Wealthramp is here to help.

©2025, Wealthramp Inc. All Rights Reserved.

Welcome to Modal Window plugin