REXBURG, Idaho — Wealthramp, the trusted platform connecting individuals with rigorously vetted fee-only fiduciary financial advisors, has partnered with Brigham […]

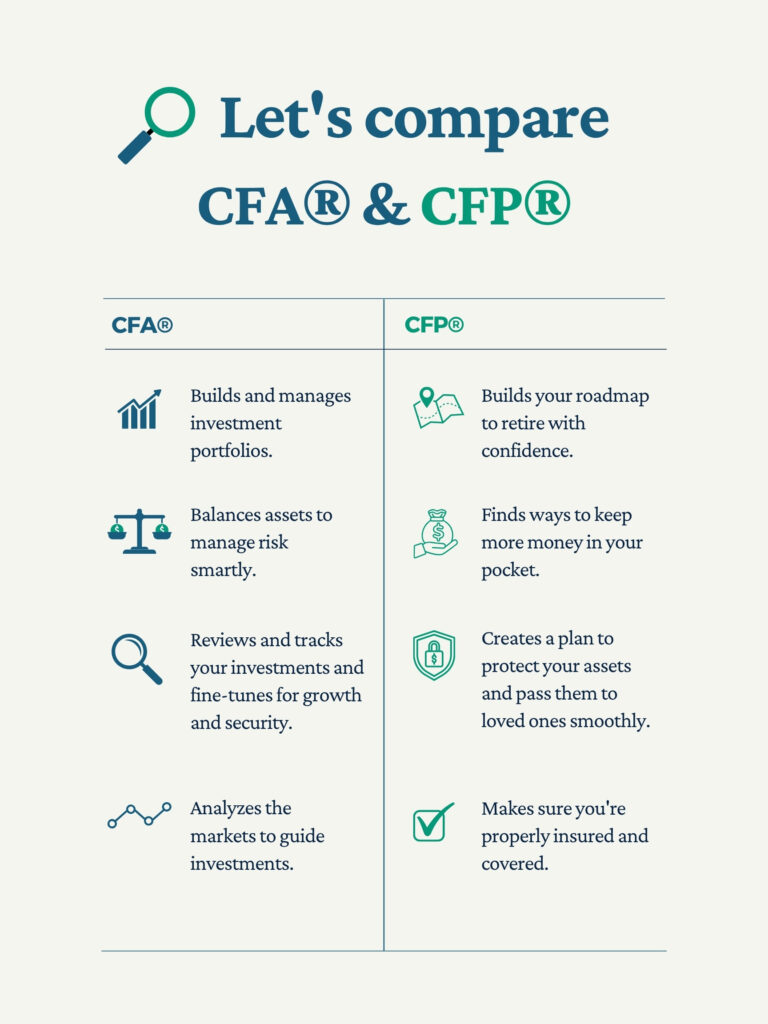

You might be asking yourself whether a CFA® or a CFP® is better for you.

It’s a smart question, and the answer really depends on what kind of financial help you’re looking for.

The truth is, not all financial credentials are created equal. Some signal deep, specialized expertise. Others? Well… they’re more for show than substance.

Chartered Financial Analyst®. Certified Financial Planner®. Both are highly respected credentials—but they’re not interchangeable. Each signals a different kind of expertise.

If you’re trying to figure out which one matters more for your own financial life, here’s what you need to know.

It starts by understanding who’s truly qualified to help you—given your personal situation and what those fancy letters after their names actually mean for you.

When you start your search for a financial advisor, you’ll quickly notice a string of initials following their name. Two of the most well-respected?

CFA® (Chartered Financial Analyst) and CFP® (Certified Financial Planner™).

But they’re not interchangeable—and depending on your financial goals, one might be a better fit for you than the other.

Let’s break it down.

A CFA® charterholder is considered one of the most elite designations in the investment world.

It’s an extremely rigorous program with three grueling exams, often taking four years to complete. CFAs typically work for investment firms, hedge funds, and pension plans.

They manage large sums of money and dive deep into securities analysis, valuation, and asset management.

Fewer than 10% of CFA® charterholders work with individuals and families.

But the ones who do focus on individuals and families bring deep investment strategy expertise, especially when paired with financial planning credentials like a CFP® or CPA.

Translation: If you need someone to manage a complex portfolio or institutional investments, a CFA’s expertise can be invaluable.

A CFP® is trained in comprehensive financial planning for individuals and families.

The CFP® exam is designed to show broad, well-rounded knowledge in personal financial planning—not just investments.

Translation: If you want help with your total financial life—not just investments—a CFP® is your go-to.

|

That depends on what you need.

If your main focus is investment management—or you're dealing with complex assets—a CFA’s deep technical expertise stands out.

If you’re looking for holistic financial advice—retirement strategies, tax efficiency, insurance coverage, estate planning, and investments in the context of your goals—a CFP® is typically the better fit.

And sometimes, an advisor can hold both designations. (But fair warning: those are unicorns.)

Beyond the letters and credentials, ask yourself:

Will this advisor always put my interests first?

Because a credential alone doesn’t guarantee integrity or trustworthiness.

At Wealthramp, that’s exactly why we vet every advisor for:

Whether they’re a CFA®, CFP®, or both—you deserve someone who listens, speaks your language, and treats your financial future like it matters. Because it does.

Q: Can a CFA® also do financial planning?

A: Yes, CFA advisors in the Wealthramp network are also experienced planners, especially as it relates to taxes—but household financial planning may not be their primary focus or training. Always ask what services they offer and how much of their time is spent on personal financial planning.

Q: Should I hire an advisor without a CFP® or CFA®?

A: There are other credible designations, but these two signal a high level of education, ethics, and expertise. Credentials matter—but so does experience, work history, and character.

Q: How do I know which type of advisor I need?

A: Start with what you actually want to accomplish. If you’re managing your investments and your portfolio is your number one concern, consider a CFA®. If you want a financial roadmap that’s focused on planning for college, working through a life event such as divorce, or estate planning for the next generation, a CFP® is often the top choice.

While many CFA® charterholders run portfolios for pension funds and other institutions, the CFAs in Wealthramp’s network work one-on-one with individuals—marrying that same deep portfolio expertise with comprehensive financial and tax planning.

In other words, when a CFA® is your financial advisor, you’re getting institutional-grade investment know-how plus the holistic guidance that ties every piece of your financial life together.

At the end of the day, it’s not about chasing the flashiest title or the longest string of letters after someone’s name.

It’s about finding a truly outstanding advisor who actually gets you.

Someone who listens before they talk.

Someone who’s earned your trust—not just through credentials, but through experience and character.

That’s exactly why Wealthramp exists.

To connect you with advisors who aren’t just qualified, but truly committed to putting you first.

Ready to find the financial advisor that’s right for you?

©2025, Wealthramp Inc. All Rights Reserved.

Welcome to Modal Window plugin