Wealthramp works for you. We’ll always protect your privacy, let you decide if you’d like to meet a recommended advisor, and we only make money when you’ve decided to work with one of our recommended advisors.

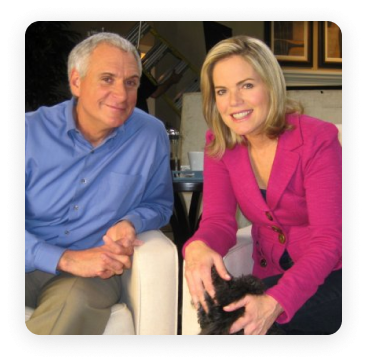

Our founder Pam Krueger is a career-long and award winning investor advocate, committed to helping people save, invest and grow their wealth. The seeds of Wealthramp were planted during the 2008 financial meltdown. As nervous investors watched their account balances plummet, viewers of Pam’s weekly PBS show MoneyTrack deluged her with the same question “how can I find a truly trustworthy financial advisor?”. From her experience working in the financial industry, Pam knew the truth: most so-called advisors are really investment or insurance sales reps, paid by commissions on investments they were incentivized to sell.

Since then, Pam has been on a relentless quest to use her financial journalist platform to educate and advocate for consumers. Armed with her passionate commitment to financial education, Pam created Wealthramp to enable people to become informed, confident investors, and to build a productive, collaborative relationship with an expert fiduciary advisor who suits their unique needs and goals.

We made our first match in 2018, backed by a rigorously vetted, hand-selected network of the very best fiduciary financial advisors throughout the U.S.

Over ten thousand matches later, Pam still personally interviews and evaluates each advisor in our network. And we’re stronger than ever because we continue to exist for consumers, not Wall Street or Venture Capitalists. Every day, our clients tell us about the extraordinary relationships they’ve developed with their advisors on Wealthramp, their growing confidence in their own financial knowledge, and the transformative power of their newfound peace of mind.

We’re here to help you get this right.